3 Ways to Practice Financial Self-Care

I hear it again and again how much anxiety, stress, and frustration stem from finances, spending, and a lack of awareness of where money is going. And can we step back for a second and get real about this?

Feeling overwhelmed with finances is NOT a character flaw, finances encompass a motherload of mental energy, period.

If you’ve ever felt like holy shit, this is ridiculously overwhelming, you’re preaching to millions of other people who feel the same way (and would rather binge watch OITNB than look at their expenses right along with you).

The magic of self-care however, is that it involves reframing how we look at the world, and how we tackle the things we don’t want to do. One key aspect of self-care is being aware of the big picture and how handling something seemingly stressful can actually make most of your stress evaporate.

There's so much information out there about budgeting, finances, etc but one thing they all seem to lack is the focus on how we feel emotionally attached to money and our beliefs around it.

And while I'm sure you've focused your time and energy around various forms of self-care, we don't tend to consider our financial health as one of the core elements.

While I have a solid budget system in place that I use in my own life, it took me a while to get to the point of being comfortable looking at my income.

I used to think I was lazy and irresponsible for not knowing ALL the details of my budget, my bills, due dates and so forth but what it really came down to was a complete lack of awareness about how I felt energetically and emotionally about money.

Once I was able to understand my limiting beliefs about money and why I was blocking myself from true financial self-care and organization, it all changed and I was able to effortlessly move forward in figuring out all the details.

I now only spend 15 minutes a month paying bills, making sure things are in place, and figuring out things like holiday savings and other financial plans. And while I'm still learning and understanding a lot about my money mindset, I'm to a place now where it's no longer hindering me from taking a solid look at the things I need to do to live the lifestyle I want.

If you're like "yeah that's me, I feel super stressed around even the THOUGHT of budgeting and taking a look at everything" then the FREE Masterclass I've put together below is for you.

In this workshop I cover the biggest money mindset beliefs that are likely holding you back, I walk you through my Financial Self-Care Framework that sets you up for success, and I give you 3 solid and actionable strategies you can use today to get going on your budget.

Today I want to talk to you about the main elements of financial self-care and how you can begin to incorporate these practices into your own life.

Here’s how:

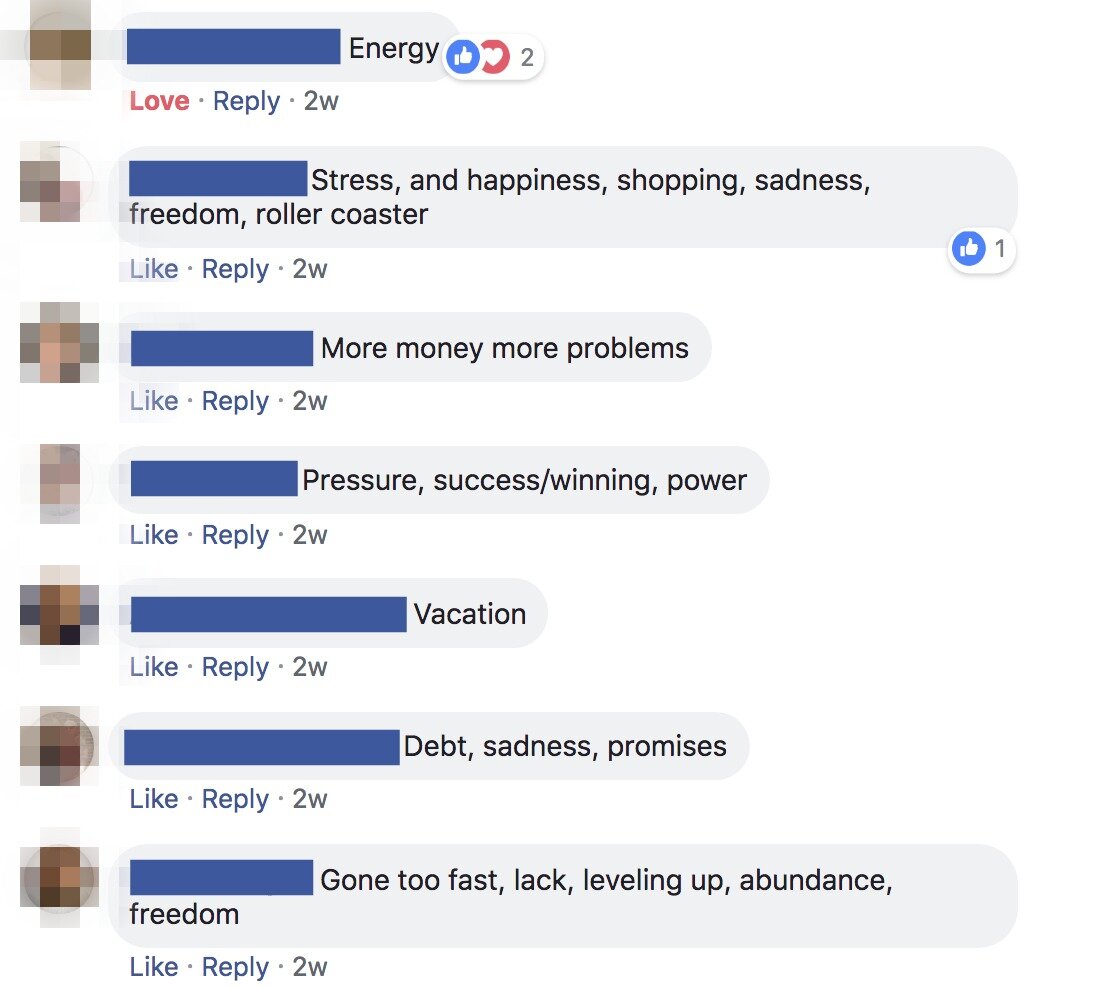

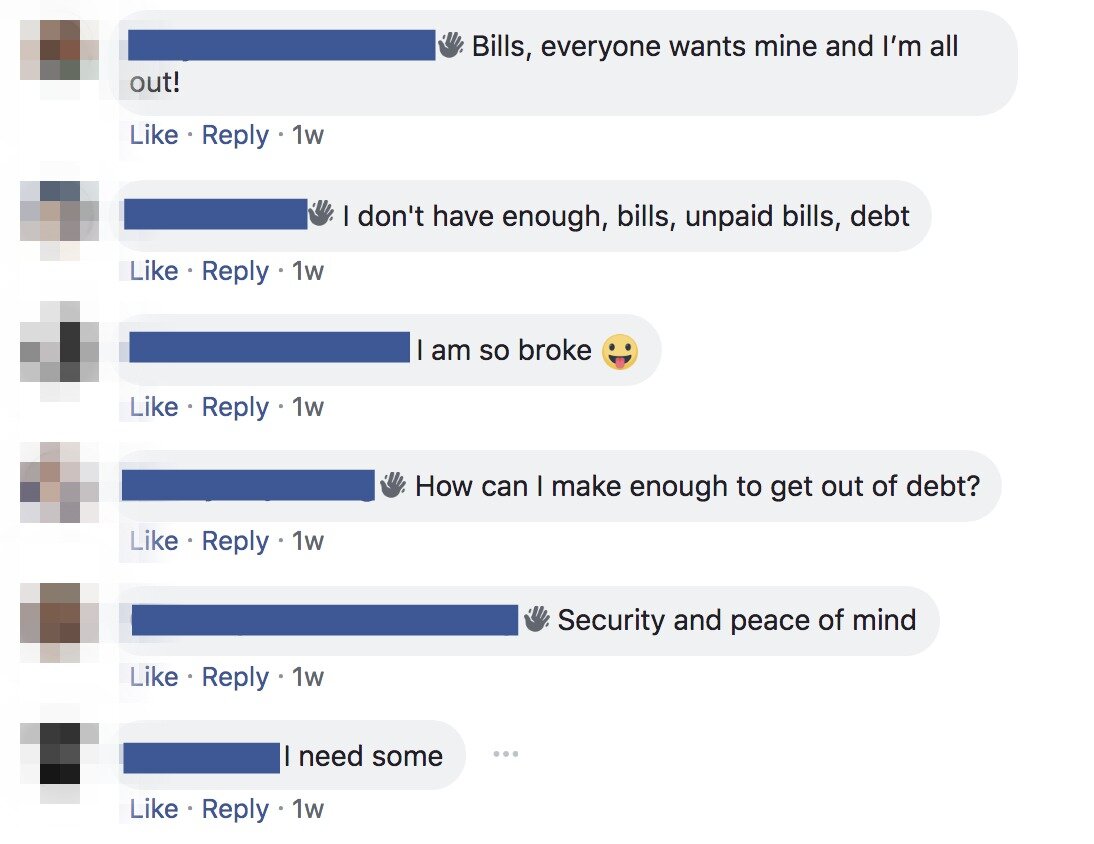

1) Write down all the ways money makes you FEEL

What are the first things that pop into your mind when you think about money? It's not something we often do. We will make time to do braindumps for our emotions, our to-do list, but when was the last time you truly took even 5-10 minutes to think about what comes up for you around money?

I recently asked this in the Mindful Productivity Facebook Community and you can see the variety of responses I got!

2) Get clear on your income.

It's nearly impossible to budget correctly and spend mindfully if you don't know how much you're working with. You might be saying, "uh, Sarah, I know what my paycheck is" - and that's totally cool. But are you clear on ALL of your income sources?

Do you receive bonuses every year? What about those two extra paychecks since there are 52 weeks in the year? Do you know WHEN you're paid for all of those things?

Having a clear sense of your income will change the way you think about money, big time.

3) Be mindful of your spending

This doesn’t mean associating guilt with spending or falling into the “should” or “shouldn’t” trap -- instead, keep a list of what you are spending your money on. I cannot tell you how many times I’ve had an extra $100 or so, only to find that it’s down to $12 in a day or two with absolutely no recollection of exactly how that happened. There was something about having (and using) and checkbook in the 90s that kept me more honest and aware.

Join me for a free on-demand masterclass where I’ll walk you through the Financial Care Framework!

In this Masterclass you'll learn:

The biggest money mindset blocks that keep you from taking control of your budget

A breakdown of the Financial Self-Care Framework

The system I use to stay on top of my budget, pay off debt, and manage my income that only takes me 15 minutes a month!

3 strategies you can use to take action on your budget today!